Discover the Acea Group online 2019 Sustainability Report

Corporate governance at Acea

The governance model adopted by Acea complies with the recommendations of the Corporate Governance Code for listed companies and with the principles of transparency, balance and separation between guidance, management and control activities.

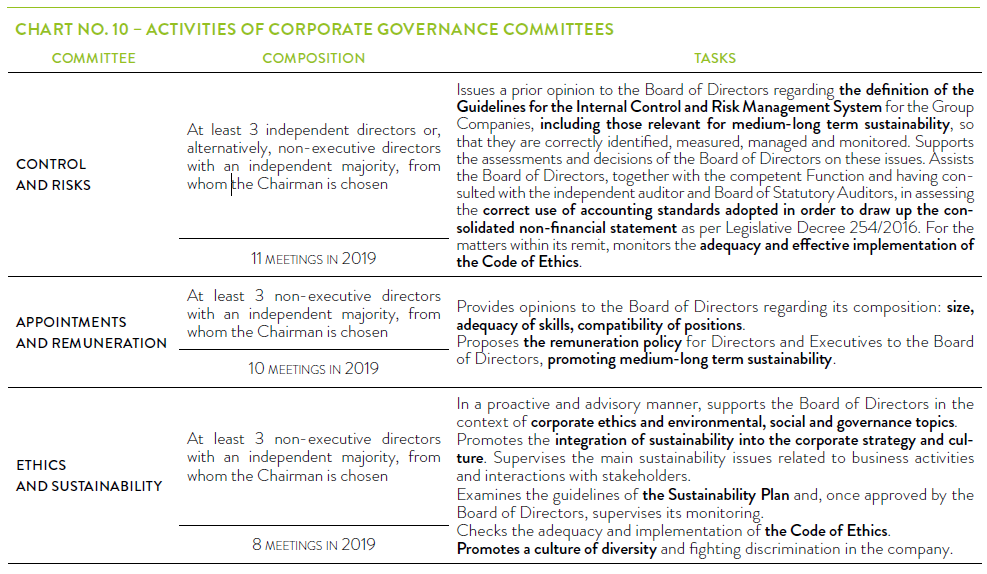

The Acea SpA Board of Directors establishes the strategic guidelines of the Group and is responsible for corporate governance. According to the best practices of the Corporate Governance Code, three committees were set up within the Board with propositional and advisory functions: the Control and Risk Committee, the Appointments and Remuneration Committee and the Ethics and Sustainability Committee.

Two other bodies are also operational: the Committee for Related Party Transactions, in implementation of Consob regulations and composed of independent directors, and the Executive Committee, set up in accordance with the Italian Civil Code (art. 2381) and the By-laws (art. 20, para. 1), composed of the Chairperson and Managing Director of Acea SpA and two independent Directors, one of whom chairs it, with powers relating to institutional affairs, sponsorships and donations, to be managed within the budget established by the Board of Directors.

CHART NO. 10 – ACTIVITIES OF CORPORATE GOVERNANCE COMMITTEES

The company is managed by the Board of Directors, which can have from 5 to 9 members depending on the decision of the Shareholders’ Meeting. The members of the BoD – identified and appointed according to Acea’s By-laws, according to applicable law – remain in office for three financial years and can be re-elected. The method for selecting the members of the Board guarantees the representation of the genders, an adequate number of Directors representing the minorities and independent Directors in accordance with the law20.

The Board in office, appointed in April 2017, is composed of 9 directors, 5 of whom are women. In April 2019, following the resignation of the Director Luca Lanzalone, the Shareholders’ Meeting appointed Ms Maria Verbena Sterpetti to the Board of Directors. In December 2019, following the resignation of the Director Fabrice Rossignol, the Board of Directors co-opted Diane Galbe.

The Board of Directors met 13 times during the year. The Chief Executive Officer is the only executive Director.

In accordance with the Corporate Governance Code, Acea carries out a board evaluation annually, availing of an external advisor in order to assess the adequacy of the dimension, composition and function of the BoD and its internal Committees, as well as the issues discussed.

The Report on corporate governance and shareholders’ structure, available on the institutional website (www.gruppo.acea.it), provides information about the Directors of Acea SpA: CVs, diversity, qualification of independence, presence in meetings of the Board and the Committees they are members of and any positions in other Companies listed in regulated markets, including abroad, in financial, banking or insurance companies or of significant size.

TABLE NO. 8 – STRUCTURE OF THE BOARD OF DIRECTORS AND COMMITTEES OF ACEA SPA (AS AT 31.12.2019)

| ROLE IN THE BoD | EXECUTIVE COMMITTEE | APPOINTMENT AND REMUNERATION COMMITTEE | CONTROL AND RISKS COMMITTEE | ETHICS AND SUSTAINABILITY COMMITTEE | EXECUTIVE DIRECTOR | INDEPENDENT DIRECTOR | |

| Mrs. Michaela Castelli | Chairman | De jure component | Member | Member | |||

| Mr. Stefano Antonio Donnarumma | MD | De jure component | X | ||||

| Mrs. Liliana Godino | Director | Chairman | Chairman | X | |||

| Mrs. Gabriella Chiellino | Director | Member | Chairman | X | |||

| Mr. Luca Alfredo Lanzalone | Director until 15/3/2019 | ||||||

| Mrs. Maria Verbena Sterpetti | Director since 17/4/2019 | X | |||||

| Mr. Massimiliano Capece minutolo del sasso | Director | Member | Member | Member | X | ||

| Mr. Alessandro Caltagirone | Director | X | |||||

| Mr. Giovanni Giani | Director | Chairman | Member | Member | Member | X | |

| Mr. Fabrice Rossignol | Director until 06/12/2019 | X | |||||

| Mrs. Diane Galbe | Director since 11/12/2019 | X |

THE ROLE AND POWERS OF THE BOARD OF DIRECTORS IN ACEA

The duties lying with the Board of Directors pursuant to the law provisions, the Articles of Association and in compliance with the recommendations provided in the Code of Conduct include:

Definition of the strategic direction;

- Economic and financial coordination of the Group’s activities;

- Definition of the guidelines of the Internal Control and Risk Management System (SCIGR), nature and level of risk compatible with the Company’s strategic objectives, including significant risks for medium-long term sustainability;

- Establishing the Committees required by the Code of Conduct and appointing their members;

- Adopting the Organization, management and control model as pursuant to Legislative Decree no. 231/01;

- Assessing the adequacy of the organisational, administrative and accounting structure of Acea and its strategic subsidiaries;

- Interacting with the shareholders, encouraging their participation and enabling them to exercise their rights;

- Evaluating the independence of its non-executive members at least on a yearly basis.

FUNCTIONS OF THE CHAIRMAN, CHIEF EXECUTIVE OFFICER

TOWARDS AN INTEGRATED GOVERNANCE STRATEGY: 2019 INTEGRATED GOVERNANCE INDEX AND ACEA POSITIONING

The Integrated Governance Index (IGI) clearly and succinctly expresses the positioning of companies in relation to sustainability governance (or integrated governance). Developed by ETicaNews, the project reached its fourth edition in 2019. With an expanding panel of companies involved, the index was applied to the first 100 companies listed on the Milan Stock Exchange, to the companies that publish a Non-Financial Statement pursuant to Legislative Decree no. 254/2016, and to the first 50 non-listed and industrial companies in the Mediobanca classification. Based on a questionnaire, the index calculates the assessment according to a predetermined score.

The questionnaire consists of an ordinary area, divided into eight areas of investigation, and an extraordinary area, which varies each year, and explores challenging issues. In 2019 the Extraordinary Area concerned the management of ESGs by the Human Resources function. The topics examined by the Ordinary Area were: Code of self-discipline and sustainability; Diversity, professionalism, independence of the board; ESG integrated into remuneration; ESG integrated into business strategies; Board committees and sustainability; Materiality, Succession plans; ESG Finance.

In the third year of participation in the IGI survey, Acea scored 62.78 (scale 0-100), ranking 23rd out of 61 respondents. In particular, the areas where Acea performed best were compliance with the Corporate Governance Code, the composition of the Board of Directors in terms of diversity and skills, the Board Committees with particular focus on the Ethics and Sustainability Committee and the Materiality Analysis. The aspects with a lower score were those relating to the integration of the ESGs in remuneration, succession plans and ESG Finance.

- the Steering Committee, composed of the first reports of the Managing Director;

- the Business Review Committee for the analysis of data and economic-financial performance;

- the Business Strategy Committee, which analyses the possibility of developing core and non-core activities in Italy;

- the Post Audit Committee, which analyses the corrective actions taken to overcome any critical issues identified in audit reports;

- the Procurement Supervisory Committee, which the Chairperson also participates in, which monitors the application of current legislation and company procurement procedures as well as the progress of the tender procedures and execution of the most significant contracts (in terms of economic value, strategic value and executive risks); informs the company bodies of new tenders and potential risks and impacts on existing and planned tender procedures.

TOP MANAGEMENT REMUNERATION DETERMINATION PROCESS

- identify the risks that can affect the pursuit of the objectives defined by the Board of Directors;

- encourage the taking of conscious decisions that are consistent with the company’s objectives, within the framework of a widespread knowledge of the risks and the level of propensity for them established by the Board of Directors, legality and company values;

- safeguard the company’s assets, the efficiency and effectiveness of its processes, the reliability of the information provided to corporate bodies and the market and compliance with internal and external regulations.

- Provide guidance for the actors of the SCIGR, so that the main risks pertaining to the Acea Group, including those regarding sustainability in the medium-long term, are correctly identified and adequately measured, managed and monitored;

- Identify the principles and responsibilities of the governance, management and monitoring of the risks connected to the Company’s activities;

- Provide for control activities at all operational levels and identify tasks and responsibilities to ensure coordination between the main subjects involved in the SCIGR.

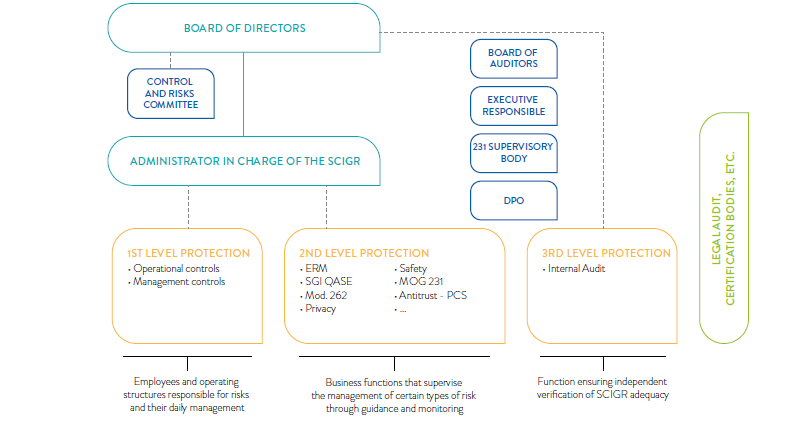

CHART NO. 11 – THE ARCHITECTURE OF THE SCIGR

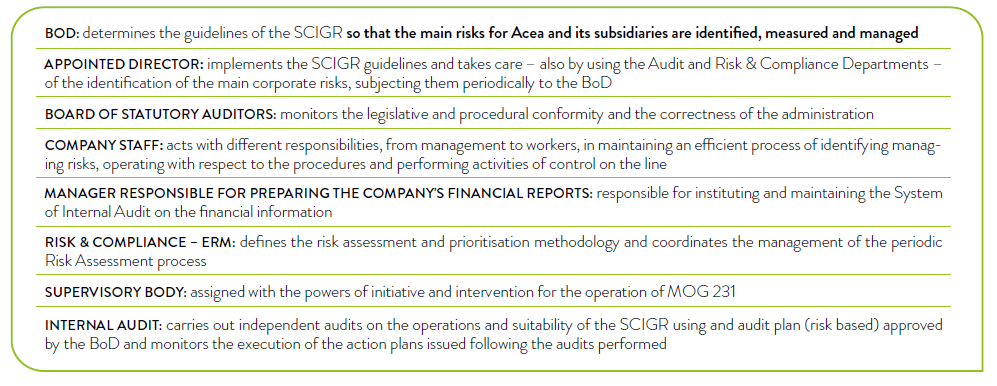

CHART NO. 12 – THE KEY PLAYERS OF THE SCIGR

Dedicated corporate structures in the Parent Company have the task of creating and adopting specific models for monitoring risks, including those relating to the commission of crimes.

TABLE NO. 9 – MODELS AND CONTROLS

| OVERSIGHT AREAS | |

| Organization, Management and Control Model as per Legislative Decree 231/01 | Risk of committing crimes and administrative offences in the performance of the Company’s activities |

| Guidelines of the Management and Control Model pursuant to Law 262/05 (updated in 2019 together with the Regulations of the Financial Reporting Officer) | Risks the Group’s Financial Statement |

| Privacy Governance Model | Compliance with EU Regulation 2016/679 (GDPR) and other national and European provisions on the protection of personal data |

| Antitrust Compliance Programme | Compliance with antitrust and consumer regulations and development of a corporate culture to ensure the protection of competition and consumers |

| Oversight of ISO45001 and ISO14001 | Monitoring workplace health and safety risks and environmental risks in accordance with international standards |

| Oversight of Cyber Security | Cyber risk management, also in compliance with EU Directive 1148/2016 on European Information Systems and Networks (NIS) |

COMPLIANCE WITH EU PERSONAL DATA REGULATION (GDPR)

ANTITRUST COMPLIANCE PROGRAMME

The Acea Group pays constant attention to compliance with antitrust law and consumer protection regulations. Following Acea’s adoption of the Antitrust Compliance Programme aimed at strengthening internal controls, implementing organizational and regulatory instruments and promoting the principles of fair competition and consumer rights and the appointment of the Holding Company Antitrust Officer, activities already carried out last year, in 2019 the main Group companies adopted the Antitrust Compliance Programme in line with the indications of the Holding Company, and set up organizational structures to which Company Antitrust Officers were appointed. These have the task of implementing the programme, depending on the specific characteristics of the company, the regulatory provisions and the market context they operate in. To this end, the Group companies are responsible for the implementation of the Compliance Programme in their own organizations. Corporate representatives also received specific training and support coordinated by the Holding Company’s Antitrust Officer, aimed at implementing their technical and regulatory skills.

Within the framework of the internal control and risk management system, Group companies adopt their own organization, management and control models pursuant to Legislative Decree no. 231/2001 to prevent the risk of certain crimes or administrative offences committed in their interest or benefit by top management or subject to the management or supervision of the latter. The development of the Models is preceded by a mapping of the business areas concerned (so-called risk areas) and the identification of sensitive activities and potential offences. The Models are updated in response to changes in the organization or activities carried out, or following the introduction of new cases in the catalogue of predicate offences of the aforementioned legislative decree. The Supervisory Body (SB) has full and autonomous powers of initiative, action and control regarding the operation, effectiveness and observance of the specific Models22.

For Acea, the adoption of principles and compliance with the rules set out in the Company Code of Ethics – an integral part of the 231 Model and the internal control system – are also relevant to prevent crimes pursuant to Legislative Decree no. 231/2001, as well as being a ready reference for all those who are addressed by the Code.

The Internal Audit function carries out the controls envisaged in the Audit Plan, approved by the Board of Directors and subject to the opinion of the Control and Risk Committee. The Plan is drawn up on the basis of the analysis and prioritisation of the main risks for Acea and its subsidiaries, carried out during the Risk Assessment, also thanks to the monitoring carried out by the corporate Functions responsible for second-level controls.

In 2019, about 81.4% of the Plan activities concerned corporate processes deemed as exposed to the risks as per Legislative Decree no. 231/01, amongst which the crimes regarding corruption and the environment, and in violation of injury prevention laws and the laws safeguarding health in the workplace.

With regard to audits of processes related to risks of corruption, there are in particular periodic audits of “Sponsorships”, “Consulting”, “Personnel selection”, “Purchasing and payments”.

As required by the professional standards of the Institute of Internal Auditors (IIA), the audits also assess the specific fraud risks of the process analysed and test the operation of the related controls. With reference to fraud detection activities, 5 Fraud Key Risk Indicators have been adopted for the purchasing area, which are analysed every six months.

REPORTS RECEIVED RELATED TO THE CODE OF ETHICS

INTEGRATED ANALYSIS AND RISK MANAGEMENT METHOD

- Represent the type and significance (probability and economic-financial and/or reputational impact) of the main risks, including sustainability risks, that may jeopardize the achievement of the Group’s strategic and business objectives;

- Address strategies and subsequent additional mitigation actions.

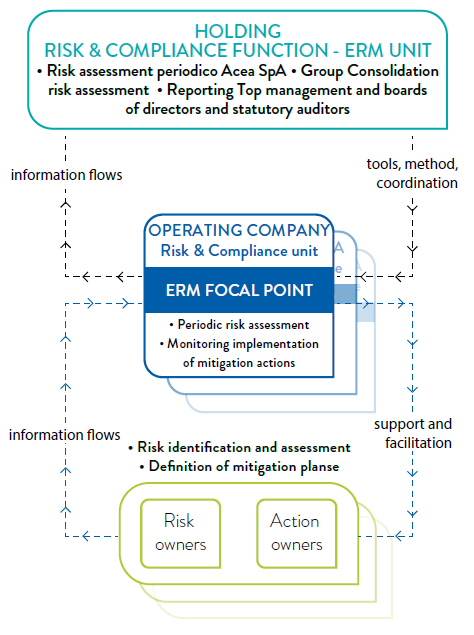

CHART NO. 13 – THE ERM UNIT AND THE CORPORATE FOCAL POINTS

TABLE NO. 10 – MATERIAL TOPICS, RISKS AND MANAGEMENT METHODS

| HIGHLY SIGNIFICANT MATERIAL TOPICS AND RELATED RISK | POTENTIAL IMPACT ON ACEA | POTENTIAL IMPACT ON STAKEHOLDERS AND CAPITAL | RISK MANAGEMENT METHOD |

| SUSTAINABLE WATER CYCLE MANAGEMENT Unfavourable natural events and/or climate change; authorisation delays impacting on optimal management conditions; monitoring and analysis | economic/financial reputational | environment and community natural and social-relational capital | - system of procedures and emergency plans – ad hoc maintenance – disciplined relations with institutions and authorising bodies – ISO 17025 accreditation Analysis laboratories |

| SUSTAINABILITY IN INFRASTRUCTURE DESIGN, CONSTRUCTION AND MANAGEMENT Environmental and social impacts from inadequate and failed design, construction and/or management of plants/networks | economic/financial reputational | environment, community, institutions, suppliers natural, production and social-relational capital | - design procedures – monitoring and reporting of the progress of the authorisation/design process – asset monitoring and inspection |

| OCCUPATIONAL HEALTH AND SAFETY Accidents at work | reputational | employees | - company policies and compliance guidelines – training and communication plans – ISO 45001 health and safety management systems |

| INNOVATION OF SMART UTILITY PROCESSES, INFRASTRUCTURE AND SERVICES Operational inefficiency due to technological and innovative inadequacy | economic/financial reputational | community and business partners production, intellectual and social-relational capital | - monitoring the technical and technological progress of projects |

| SUSTAINABILITY AND CIRCULARITY ALONG THE SUPPLY CHAIN Failure to control the purchasing process – failure of suppliers to comply with the requirements (health and safety, environmental, anti-corruption) | economic/financial reputational | environment and suppliers natural, human and social-relational capital | - system of procedures – quality monitoring of goods/services received – ISO 45001 health and safety management systems – qualified suppliers register |

| RECOVERY OF WASTE FOR A CIRCULAR ECONOMY Failure to comply with regulations; obstacles in the waste treatment and delivery market | economic/financial | environment natural capital | - monitoring and control plans for Integrated Environmental Authorisations – ISO14001 and EMAS environmental management system |

| STRATEGIC APPROACH TO STAKEHOLDER RELATIONS Tensions with stakeholder representatives in the region with negative effects on the development of activities | economic/financial reputational | community social-relational capital | - stakeholder engagement activities – Code of Ethics |

| BUSINESS ETHICS AND INTEGRITY Conduct contrary to binding regulations, internal rules and standards of reference | economic/financial reputational | community, institutions and business partners production, intellectual and social-relational capital | - 231/01 organization, management and control model – Code of Ethics – whistleblowing system – training and communication plans |

| CUSTOMER FOCUS Failure to achieve service quality levels until they are discontinued | economic/financial reputational | customers social-relational capital | - customer analysis – analysis of services – monitoring of regulatory framework of reference (e.g. Consumer Code) – ISO 9001 quality management system |

| AIR QUALITY: CONTAINMENT OF POLLUTANT EMISSIONS INTO THE ATMOSPHERE Exceeding the emission limits envisaged by laws and authorisation decrees | economic/financial reputational | environment and community natural capital | - monitoring and control plans (Integrated Environmental Authorisations) – ISO 14001 and EMAS environmental management system |

| INVOLVEMENT OF PERSONNEL, INVESTMENT IN HUMAN CAPITAL AND DEVELOPMENT OF SKILLS Lack of adequacy both in terms of skills and organic plants | economic/financial | employees human capital | - remuneration and incentive policies – performance evaluation system – training and education plans |

| PROTECTION OF THE COMMUNITY AND BIODIVERSITY Impacts on environmental balance conditions caused by plants that unexpectedly do not comply with legal limits | economic/financial reputational | environment natural capital | - plant management procedures – control and monitoring – training plans – ISO14001 and EMAS environmental management system |

| DECARBONISATION AND ADAPTATION TO CLIMATE CHANGE Failure to build sustainable plants and to adapt operating practices to the evolution of climate change (production of energy from renewable sources, resilience of the electricity grid, availability of water) | economic/financial reputational | environment and community natural and production capital | - monitoring and reporting – ISO 14001 and EMAS environmental management system – ISO 50001 energy management system |

| CONSOLIDATION OF SUSTAINABILITY ELEMENTS IN CORPORATE GOVERNANCE Violation of Italian Legislative Decree 254/16; inadequacy of the internal regulatory system with respect to the guidelines of the Corporate Governance Code | reputational | shareholders economic-financial and intellectual capital | - auditor’s assurance – activities of the board committees (Ethics and Sustainability, Control and Risks) – Sustainability consultation table – certification of data managers – updating and verification of information systems and organization |

| BUSINESS EVOLUTION THROUGH OPEN INNOVATION AND DEVELOPMENT OF SYNERGIES WITH SCIENTIFIC AND ENTREPRENEURIAL PARTNERS Inability to seize opportunities deriving from technological innovations and their integration into business processes | economic/financial | community, institutions and business partners production, intellectual and social-relational capital | - organizational structure responsible for innovation (innovation board and ITS function) |

| COMPANY WELL-BEING, DIVERSITY AND INCLUSION Increased absenteeism rate; negative company climate; possible lawsuits from employees | reputational | employees intellectual and social- relational capital | - “Protection, inclusion, promotion of diversity and workers’ well-being” procedure – teleworking – diversification of working hours and economic adjustments – Code of Ethics – Diversity management charter – health plans (health check-ups) |

ACEA AT THE CSR MANAGER NETWORK WORKING GROUP ON ERM AND SUSTAINABILITY

TABLE NO. 11 – RISKS AND OPPORTUNITIES RELATED TO CLIMATE CHANGE: CDP EVIDENCE

| TYPE OF RISK | DESCRIPTION OF THE RISK | MOST IMPACTED INDUSTRIAL AREAS | |

| TRANSITION Risk arising form the ongoing transition to decarbonized economic system (e.g. regulatory, technological, market) | The main risks identified relate to the political-regulatory sphere. The expected scenarios related to a transitionto an economic system committed to tackling climate change take the following forms: increasing carbon tax policies; changes in incentive programmes; tightening of the values associated with the Emission Trading Scheme (both in terms of allowances – paid or not – and actual emission allowance costs); increased legal and financial risks for non-compliance with performance standards (fines and incremental compliance costs). | Energy production (thermoelectric and waste-to-energy) Management of electrical grids Management of water | |

| PHYSICAL Risks arising from the physical effects of climatic events (acute if related to episodic phenomena, or chronic if related to long-term changes) | The main risks identified relate to both extreme weather events and possible chronic environmental changes: stress on the resilience of the power grid due to extreme weather events; changed weather conditions with impact on the availability of water for human consumption. | Management of electrical grids Management of water | |

| OPPORTUNITIES | |||

| Circular economy | Opportunities to promote circular economy models and waste recovery projects, for example with thermal renewal processes combined with material recovery (sodium). | Environment Segment | |

| Development of photovoltaic plants | Opportunities related to the diversification of production facilities with the acquisition and/or construction of photovoltaic plants that, in addition to receiving incentives for the feeding of electricity produced into the grid, allow balancing any reductions in hydroelectric production. | Production of electricity | |

| Increase in network resilience | Opportunities arising from investments promoted by the Authority for the safety of the electricity network. | Distribution of electricity | |

| Market and services | Opportunities arising from the change in energy demand related to changes in peak ambient temperatures, with an impact on price growth and volumes sold. | Energy sales | |

ANALYSIS OF POTENTIAL ENVIRONMENTAL RISKS

20 Pursuant to art. 147 ter., para. 4 of Legislative Decree 58/98, so-called Finance Act (TUF), the minimum number of independent Directors must be 1 in the case of a BoD up to 7 members, 2 in the case of BoD exceeding 7 members. During the year the BoD verified that the Directors met the conditions required to qualify as independent. As at 31/12/2019, 7 directors are effectively independent.

21 With the exception of 416,993 own shares (corresponding to about 0.2% of the total shares) for which the right of vote is suspended pursuant to art. 2357-ter Civil Code. See also the Report on corporate governance and the shareholders’ structure 2019.