Discover the Acea Group online 2019 Sustainability Report

Ownership structure own assets and general economic indicators

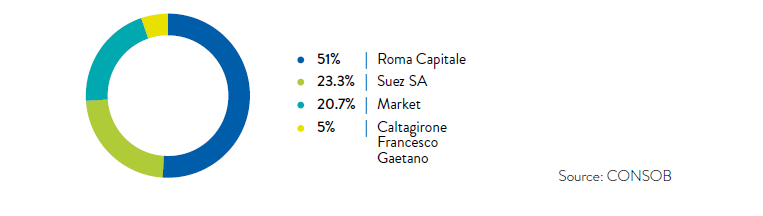

Acea SpA is listed on the Italian Stock Exchange organized and managed by Borsa Italiana. The Company is included in the FTSE Italia Mid Cap Index. Roma Capitale is Acea SpA’s majority shareholder, holding 51% of its share capital. As at 31.12.2019, other significant direct or indirect equity interests were held by Suez for over 23% and Caltagirone Francesco Gaetano at approx. 5% (see chart no. 5).

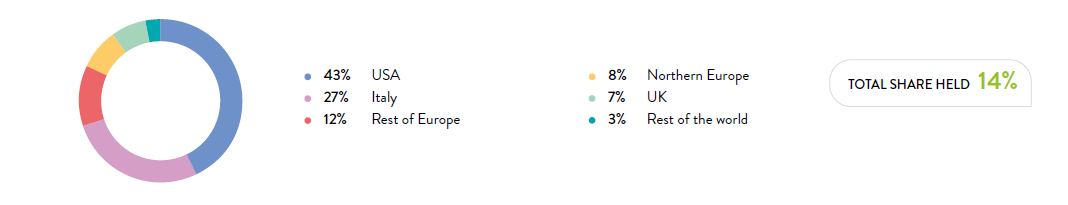

Institutional investors control more than 14% of the share capital, with a geographical distribution that shows a predominance of American shareholders, followed by those in Italy, Norway and the UK (see chart no. 6).

Retail investors hold less than 5% of the share capital.

(Economic performance) 2019 saw positive results for the Group and further growth compared to 2018, exceeding the guidance communicated to the market. The performance achieved is part of the steady growth seen over the last three years, which reflects the economic and financial environment combined with the best results achieved by the Group and the sustained growth of its capitalization, and the expansion of the company’s scope and industrial activities. The items in the financial statements are all positive: EBITDA stabilized at €1,042 million (+12% compared to 2018) and EBIT amounted to €518 million (+8% compared to 2018).

The Group profit was €284 million (+5% compared to 2018).

CHART NO. 5 – PROPRIETARY STRUCTURE AS AT 31.12.2019

CHART NO. 6 – GEOGRAPHICAL REPRESENTATION OF THE INSTITUTIONAL INVESTORS IN ACEA

TABLE NO. 7 – THE MAIN ECONOMIC AND EQUITY DATA OF THE ACEA GROUP (2018-2019)

| (in million €) | 2018 | 2019 |

| net revenues | 3,028.5 | 3,186.1 |

| operating costs | 2,138.5 | 2,185.3 |

| staff costs | 219.6 | 248,9 |

| xternal costs | 1,918.9 | 1,936.4 |

| income/(expense) from non-financial investments | 43.3 | 41.4 |

| gross operating margin (EBITDA) | 933.2 | 1,042.3 |

| gross operating margin (EBIT) | 478.5 | 518.1 |

| financial management | (82.9) | (90.3) |

| investments management | 13.3 | 2.6 |

| profit/(loss) before tax | 409 | 430.3 |

| income tax | 124.3 | 123.2 |

| net profit/loss | 284.7 | 307.2 |

| profit/loss attributable to third parties | 13.7 | 23.5 |

| net profit/(loss) of the Group | 271 | 283.7 |

Consolidated revenues in 2019 amounted to €3,186.1 million (€3,028.5 million in 2018), up 5%, mainly as a result of the strong increase in the water segment (€221 million more than in the previous year).

External costs remain essentially stable at approximately €1.93 billion (compared to €1.91 billion in 2018). Cost trends are mainly affected by the change in the scope of consolidation.

The EBITDA of approximately €1,042 million is up from €933 million last year (+12%), and performed better than the guidance.

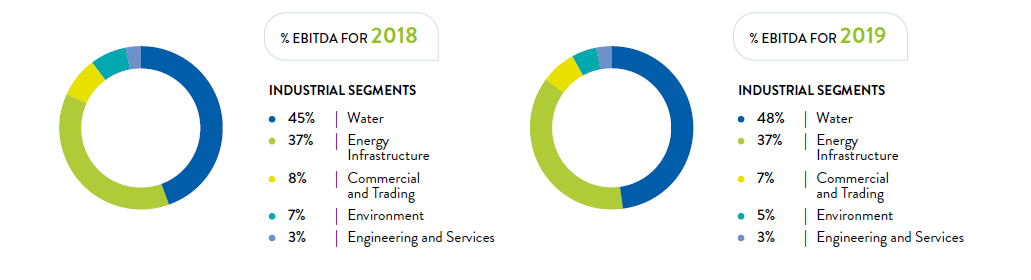

The Industrial Segments contributed to the overall value of EBITDA, as follows:

- Water operating segment at 48%, with €505 million, a 17% increase respect to the data from 2018 (€433 million). The change is attributable to the results of the newly consolidated companies such as Gori, AdF and Pescara Distribuzione Gas;

- 37% from the Energy Infrastructure industrial segment, with €392 million, up about 9% from the previous year (€361 million). This positive change is mainly attributable to Areti, following the annual tariff updates of the distribution for greater investments;

- Commercial and Trading accounted for 7%, with €69 million, down 9% (€76 million);

- the Environment industrial segment accounted for 5%, with €52 million, down about 21% from the previous year (€66 million) due to lower revenues from the CIP6 tariff.

Also contributing to the Group EBITDA are the Overseas segment and the Engineering and Services segment totaling 3%.

CHART NO. 7 – CONTRIBUTION OF THE BUSINESS AREAS TO OVERALL EBITDA (2018-2019)

Operating profit (EBIT) came to €518 million, up by €40 million (+8% on 2018). The increase is limited by the growth in amortization and depreciation as a result of changes in the Group’s scope.